How the rise of intangible assets is forcing leaders to up their game

RELATED EVENT - Boost your business savvy! Watch the replay of "Business Skills for HR Leaders" featuring Interplay, a fun and interactive experience tailored especially for HR/talent development leaders and designed to help you reach beyond the people side of human capital management to strategic action in the C-Suite.

Accounting is often referred to as the “language of business” and leaders who have mastered basic financial terms and concepts are said to have “financial literacy.” The importance of these skills to business leaders is hard to underestimate. Imagine attempting to communicate and navigate in an environment where you don’t speak the language and can’t read the signs? It’s nearly impossible. You might survive but you almost certainly won’t thrive.

For that reason, learning the language of business is not one of those “nice to have” capabilities that can assist your career if you happen to acquire it, it is a necessity. However, many leaders today who are thrust into a management role lack a basic understanding of financial statements. The Harvard Business Review reported that when U.S. managers were asked to take a basic financial literacy exam, a majority were unable to distinguish profit from cash, many didn’t know the difference between an income statement and a balance sheet, and about 70% couldn’t pick the correct definition of “free cash flow.” The average score was 38%.

The rise of intangible assets

To complicate matters, in recent decades, the ability to interpret financial statements has become more challenging. This is primarily due to the shift from an economy dominated by tangible assets to one dominated by intangible assets.

Tangible assets are physical in nature. For example, they might include buildings, property, specialized equipment, trucks, inventories or computer hardware. Intangible assets, on the other hand, are non-physical in nature. These might include, for example, the brand, the culture, software, the talent you have in-house, the customer experience and customer loyalty.

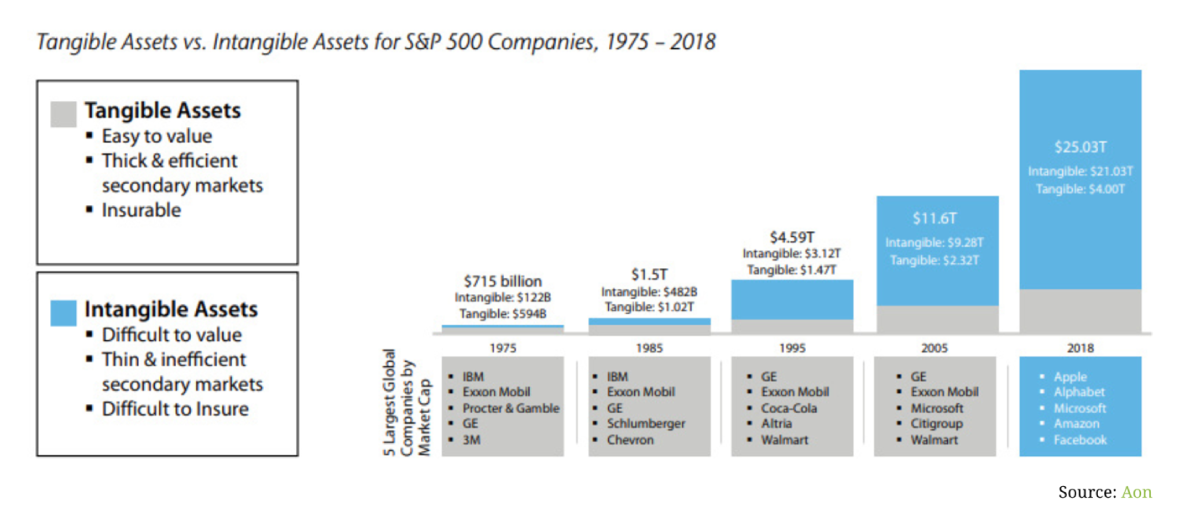

Fifty years ago, tangible assets comprised a much larger role as a percentage of total assets. A study by Aon and the Poneman Institute analyzed how tangible and intangible assets have changed overtime in the S&P 500:

Source: Aon

In 1975, Intangibles comprised just 17% of enterprise value in the S&P500, while today that number is 85%. The digital economy is driving much of this transformation, but it also reflects the increasing relative importance of all intangible assets.

Intangible assets are treated differently

The rise of intangible assets presents a challenge for managers. Tangible and intangible assets are treated differently in the accounting world, and these differences can have a profound impact on the financial results reported by companies. Understanding how and where intangible investments show up in financial statements – and learning how to use that information to measure organizational performance and make better decisions – is an increasingly critical leadership skill.

Even financial analysts sometimes struggle to make sense of how intangibles are treated by accounting. A recent research report from Morgan Stanley provides an excellent example of the different ways tangible and intangible investments show up in financial statements. In the report, the author, Michael Mauboussin, proposes two hypothetical companies:

Company A buys a machine for $1,000 that has an estimated useful life of 5 years. The present value of expected cash flows generated by the machine is $1,500.

Company B spends $1,000 to acquire a subscriber who is expected to remain a customer for 5 years. The present value of the customer’s expected cash flows is $1,500.

The economic profile of these investments is identical, but their accounting treatment is different. Company A records the machine as a cap ex “investment” and expenses the machine purchase over 5 years by depreciating it at the rate of $200 a year. Company B immediately reflects the $1,000 customer acquisition as an expense in SG&A.

Note that Company B will “lose” more in bottom-line earnings in the short term the more customers it acquires (assuming the same customer acquisition costs) even though acquiring customers creates equal value as the machine.

Source: Morgan Stanley Counterpoint Global Insights – Intangibles and Earnings: Improving the Usefulness of Financial Statements (April 12, 2022)

We expect business managers to fully understand the trade-offs and financial impact of investment decisions like these, but most are lacking the necessary financial acumen. With the increasing scrutiny from Wall Street on quarterly earnings and the growing importance of intangible assets, it is more critical than ever that business leaders have the skills necessary to navigate these challenging waters.

Learn more about how companies are accelerating modern business acumen by enrolling leaders in Interplay, a team-based business simulation – a mini-MBA in-a-day – that is uniquely designed to teach the leadership skills necessary skills to thrive in today’s economy.

Sources

- Intangibles and Earnings: Improving the Usefulness of Financial Statements, Michael J. Mauboussin and Dan Callahan, Morgan Stanley, April 12, 2022.

- AON: Intangible Assets Strategy, Capital Markets and Risk Management.

- Are Your People Financially Literate? Karen Berman and Joe Knight, Harvard Business Review, October 2009.